UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

ý | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material under §240.14a-12 | |

| Neos Therapeutics, Inc. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

April 24, 201921, 2020

Dear Neos Stockholder:

On behalf of the Neos Therapeutics, Inc. Board of Directors and our senior management team, I am pleased to invite you to attend our 20192020 Annual Meeting of Stockholders to be held virtually on Thursday,Wednesday, June 13, 201910, 2020 at 8:00 a.m. CDT at our offices, which are located at 2940 N. Highway 360, Suite 400, Grand Prairie, Texas 75050.https://web.lumiagm.com/266220294. The password for the meeting is neos2020. You will then have to click on "I have a login" and enter the 11-digit control number included on the proxy card mailed to you.

The attached Notice of 20192020 Annual Meeting of Stockholders and proxy statement contain important information about the meeting and the business to be conducted at the Annual Meeting.

Pursuant to the Securities and Exchange Commission rules that allow issuers to furnish proxy materials to stockholders over the Internet, we are posting the proxy materials on the Internet and delivering a notice of the Internet availability of the proxy materials (the "Notice"). On or about April 24, 2019,21, 2020, we will begin mailing to our stockholders the Notice, which contains instructions on how to access or request a copy of our proxy statement for the 20192020 Annual Meeting of Stockholders and our Annual Report on Form 10-K for the year ended December 31, 2018.2019.

Your vote is very important. Whether or not you plan to attend the virtual Annual Meeting, I hope that you will vote as soon as possible. You may vote over the Internet prior to the meeting or in person atduring the virtual Annual Meeting or, if you requested printed copies of proxy materials, you also may vote by mailing a proxy card. Please review the instructions on the Notice or on the proxy card regarding your voting options.

We look forward to seeing you at the Annual Meeting. As always, thank you for your continued support of Neos.

| Sincerely, | ||

Gerald McLaughlin President and Chief Executive Officer |

To ensure your representation at the meeting, whether or not you plan to attend the virtual meeting, please vote your shares as promptly as possible over the Internet by following the instructions on your Notice or, if you requested printed copies of your proxy materials, by following the instructions on your proxy card. Your participation will help to ensure the presence of a quorum at the meeting and save Neos the extra expense associated with additional solicitation. If you hold your shares through a broker, your broker is not permitted to vote on your behalf in the election of directors, unless you provide specific instructions to the broker by completing and returning any voting instruction form that the broker provides (or following any instructions that allow you to vote your broker-held shares via the Internet). For your vote to be counted, you will need to communicate your voting decision before the date of the Annual Meeting. Voting your shares in advance will not prevent you from attending the Annual Meeting, revoking your earlier submitted proxy or voting your stock in person.during the meeting.

NOTICE OF |

| Date and Time: | ||

Place: | ||

Items of Business: | Proposal 1: Election of the | |

Proposal 2: Ratification of the appointment of RSM US LLP as the Company's independent registered public accounting firm for the fiscal year ending December 31, | ||

To transact any other business properly brought before the Annual Meeting (including adjournments and postponements | ||

Record Date: | ||

A list of stockholders of the Company entitled to vote at the Annual Meeting will be available for inspection by any stockholder at the Annual Meeting and during normal business hours at the Company's corporate offices during the 10-day period immediately prior to the date of the Annual Meeting. | ||

Proxy Voting: | Your vote is very important, regardless of the number of shares you own. We urge you to promptly vote by telephone, by using the Internet, or, if you received a proxy card or instruction form, by completing, dating, signing and returning it by mail. For instructions on voting, please see Questions and Answers about Voting beginning on page 2. |

April 24, 201921, 2020

| By order of the Board of Directors, | ||

Corporate Secretary Neos Therapeutics, Inc. |

WE URGE YOU TO VOTE YOUR SHARES AS PROMPTLY AS POSSIBLE OVER THE INTERNET, BYBY TELEPHONE, OR, IF YOU REQUESTED PRINTED COPIES OF YOUR PROXY MATERIALS BYBY COMPLETING, SIGNING AND RETURNING THE PROXY CARD IN THE ENVELOPE PROVIDED.PROVIDED. IF YOU DECIDE TO ATTEND THE VIRTUAL ANNUAL MEETING, YOU MAY, IF SO DESIRED,DESIRED, REVOKE YOUR PROXY AND VOTE YOUR SHARES IN PERSON.AT THE MEETING.

TABLE OF CONTENTS |

INFORMATION ABOUT THE | 1 | |

| | | |

Questions and Answers About the Proxy Materials | 1 | |

Questions and Answers About Voting | 2 | |

CORPORATE GOVERNANCE | 6 | |

| | | |

Governance Policies and Practices | 6 | |

Role of the Board and Leadership Structure | 7 | |

Other Board Practices | 9 | |

Board Meetings and Committees | 11 | |

Director Independence | 12 | |

Code of Ethics | 13 | |

Certain Transactions | 13 | |

PROPOSAL 1. ELECTION OF DIRECTORS | 15 | |

| | | |

Process for Selecting and Nominating Directors | 15 | |

Board of Directors' Nominees | 16 | |

NON-EMPLOYEE DIRECTOR COMPENSATION | ||

| | | |

Overview | ||

Director Compensation Program | ||

Director Compensation Table for | ||

PROPOSAL 2. RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS | ||

| | | |

REPORT OF THE AUDIT COMMITTEE | ||

| | | |

EXECUTIVE COMPENSATION | ||

| | | |

Overview | ||

| ||

Narrative to | 31 | |

Outstanding Equity Awards at Year-End | 34 | |

Executive Officer Agreements | 35 | |

Executive Officers | 38 | |

OWNERSHIP OF NEOS COMMON STOCK | 39 | |

| | | |

Security Ownership of Certain Beneficial Owners, Directors and Executive Officers | 39 | |

| ||

| 41 | |

| | | |

Notice of 20192020 Annual Meeting of Stockholders and Proxy Statement

INFORMATION ABOUT THE |

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS

Why did I receive proxy materials? What is included in the proxy materials? |

Our Board of Directors is soliciting your proxy to vote at the 20192020 Annual Meeting of Stockholders (the "Annual Meeting") and at any adjournment or postponement of the Annual Meeting for the purposes set forth in this proxy statement and the accompanying Notice of Internet Availability of Proxy Materials (the "Notice"). You received proxy materials because you owned shares of Neos common stock at the close of business on April 23, 2019,13, 2020, the record date, and that entitles you to vote at the 20192020 Annual Meeting of Stockholders.

The proxy materials include the Notice, the proxy statement, and our Annual Report on Form 10-K for the year ended December 31, 20182019 and, if you received paper copies, a proxy card or voting instruction form. The proxy statement describes the matters on which the Board of Directors would like you to vote, and provides information about Neos that we must disclose under Securities and Exchange Commission ("SEC") regulations when we solicit your proxy.

Your proxy will authorize specified persons, each of whom also is referred to as a proxy, to vote on your behalf at the Annual Meeting. By use of a proxy, you can vote whether or not you attend the virtual Annual Meeting in person.Meeting. The written document by which you authorize a proxy to vote on your behalf is referred to as a proxy card.

We intend to mail the Notice to you, unless you have requested a printed copy of the proxy materials, on or about April 24, 201921, 2020 to all stockholders of record entitled to vote at the Annual Meeting.

How can I get access to the proxy materials? |

The Notice contains instructions on how to access our proxy materials online. At the website, you may:

Rules adopted by the SEC allow companies to send stockholders a notice of Internet availability of proxy materials only, rather than mail them full sets of proxy materials. We have elected to take advantage of this alternative "notice only" distribution option. The Notice contains instructions on how stockholders can access our Notice of Annual Meeting and proxy statement via the Internet. It also contains instructions on how stockholders could request to receive their materials electronically or in printed form on a one-time or ongoing basis.

If you hold your shares through a bank, broker or other custodian, you also may have the opportunity to receive the proxy materials electronically. Please check the information contained in the documents provided to you by your bank, broker or other custodian.

We encourage you to take advantage of the availability of the proxy materials electronically to help reduce the environmental impact of the Annual Meeting.

| | |

| | Notice of |

INFORMATION ABOUT THE |

QUESTIONS AND ANSWERS ABOUT VOTING

What am I voting on at the Annual Meeting? |

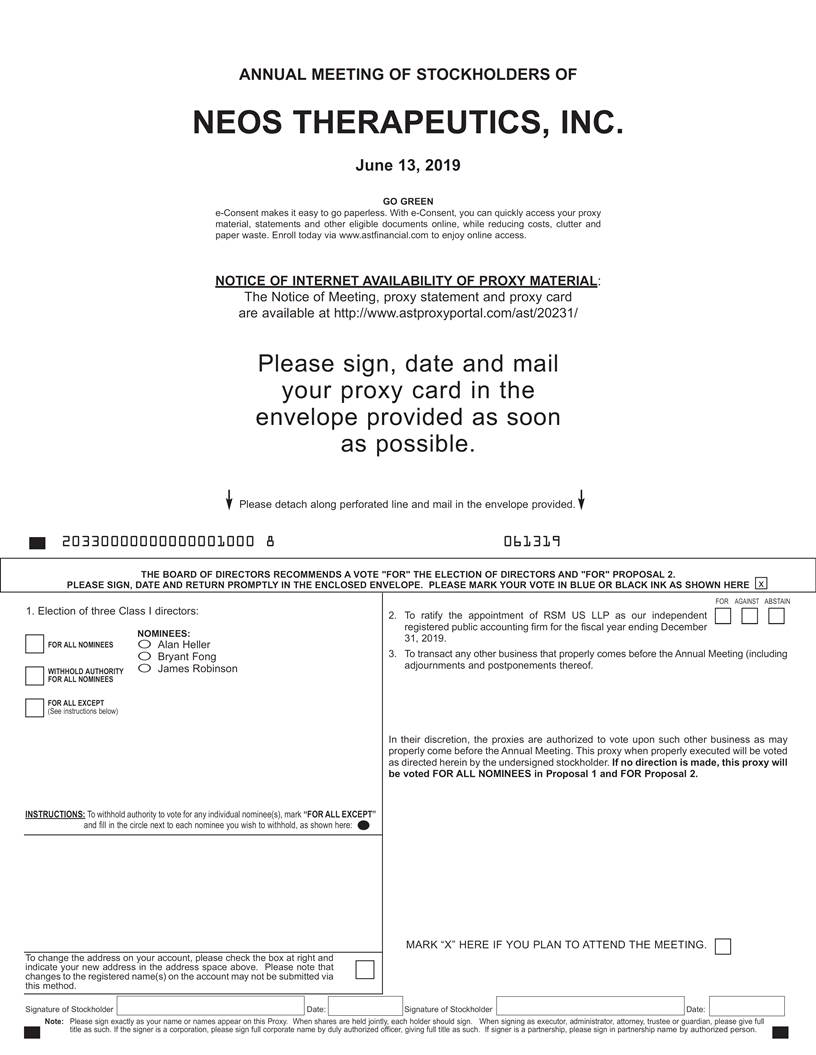

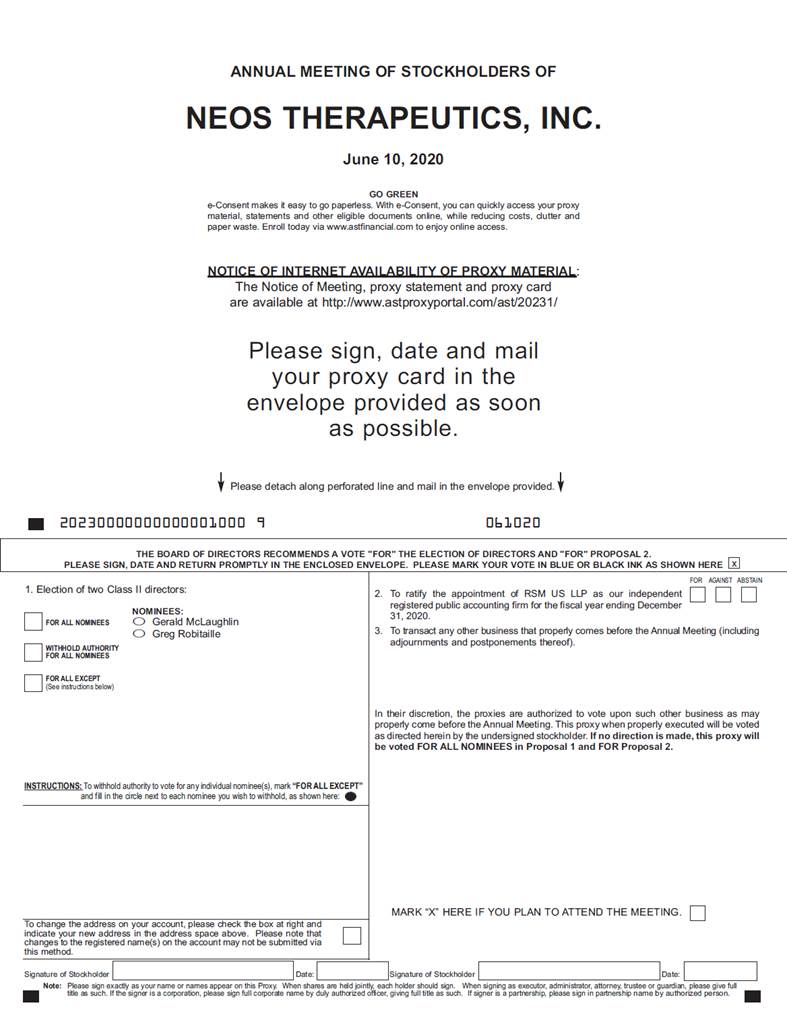

| | | | | | | | | | | | | | | | | | ||||

| Proposal | Description | Board's Vote Recommendation | Page | | Proposal | Description | Board's Vote Recommendation | Page | | |||||||||||

| 1 | Election of the three director nominees named in this proxy statement for terms expiring at the 2022 Annual Meeting of Stockholders | VoteFOR each of the nominees | 15 | 1 | Election of the two director nominees named in this proxy statement for terms expiring at the 2023 Annual Meeting of Stockholders | VoteFOR each of the nominees | 15 | |||||||||||||

| | 2 | Ratification of appointment of RSM US LLP as the Company's independent registered public accounting firm for the fiscal year ending December 31, 2019 | VoteFOR | 24 | | 2 | Ratification of appointment of RSM US LLP as the Company's independent registered public accounting firm for the fiscal year ending December 31, 2020 | VoteFOR | 25 | | ||||||||||

| | | | | | | | | | | | | | | | | | ||||

Could other matters be decided at the Annual Meeting? |

We are not aware of any other matters that will be presented and voted upon at the Annual Meeting. Our 20182019 proxy statement described the requirements under our governance documents for properly submitting proposals or nominations from the floor at this year's Annual Meeting. The proxies will have discretionary authority, to the extent permitted by law, on how to vote on other matters that may come before the Annual Meeting.

How many votes can be cast by all stockholders? |

Each share of Neos common stock is entitled to one vote on each of the threetwo directors to be elected and one vote on each of the other matters properly presented at the Annual Meeting. We had 49,722,51649,743,955 shares of common stock outstanding and entitled to vote on the record date, April 23, 2019.13, 2020.

How many votes must be present to hold the Annual Meeting? |

A majority of the issued and outstanding shares entitled to vote, or 24,861,25924,871,978 shares, present in person or by proxy, are needed for a quorum to hold the Annual Meeting. Abstentions and broker non-votes (discussed below) are included in determining whether a quorum is present. We urge you to vote by proxy even if you plan to attend the Annual Meeting. This will help us know that enough votes will be present to hold the Annual Meeting.

How many votes are needed to approve each proposal? How do abstentions or broker non-votes affect the voting results? |

The following table summarizes the vote threshold required for approval of each proposal and the effect on the outcome of the vote of abstentions and uninstructed shares held by brokers (referred to as broker non-votes). When a beneficial owner does not provide voting instructions to the institution that holds the shares in street name, brokers may not vote those shares in matters deemed non-routine. Proposal 1 below is deemed to be a non-routine matter, and, as a result, your broker or nominee may not vote your shares on Proposal 1 in the absence of your instruction. Proposal 2 is considered to be a "routine" matter, and, as a result, your broker or nominee may vote your shares in its discretion either for or against Proposal 2 even in the absence of your instruction. If you are a beneficial owner and want to ensure that

2 Notice of 20192020 Annual Meeting of Stockholders and Proxy Statement

INFORMATION ABOUT THE |

all of the shares you beneficially own are voted for or against Proposal 2, you must give your broker or nominee specific instructions to do so.

| | | | | | | | | | | | | |

| | Proposal Number | Summary Description | Vote Required for Approval | Effect of Abstentions | Effect of Broker Non-Votes | | ||||||

| 1 | Election of directors | Plurality of votes cast | No effect | Not voted/No effect | ||||||||

| | 2 | Ratification of the appointment of independent auditor | Majority of shares present and properly cast for and against such matter | No effect | Shares may be voted by brokers in their discretion but any non-votes have no effect | | ||||||

| | | | | | | | | | | | | |

Signed but unmarked proxy cards will be voted "for" each proposal.

How do I vote if I own shares as a record holder? |

If your name is registered on Neos' stockholder records as the owner of shares, you are the "record holder." If you hold shares as a record holder on the record date, there are four ways that you can vote your shares.

How do I vote if my Neos shares are held by a bank, broker or custodian? |

If your shares are held by a bank, broker or other custodian (commonly referred to as shares held "in street name"), the holder of your shares will provide you with a copy of this proxy statement, a voting instruction form and directions on how to provide voting instructions. These directions may allow you to vote over the Internet or by telephone.

Proposal 1 is deemed to be a "non-routine" matter, and as a result, your broker or nominee may not vote your shares in the absence of your instruction. In such a circumstance, shares not voted by the broker would result in broker non-votes. Because the vote required to approve Proposal 1 is a plurality of votes properly cast for an against such matter, broker non-votes have no effect on the approval of Proposal 1.

| | |

| | Notice of |

INFORMATION ABOUT THE |

would result in broker non-votes. Because the vote required to approve Proposal 1 is a plurality of votes properly cast for and against such matter, broker non-votes have no effect on the approval of Proposal 1.

Proposal 2 is deemed to be a "routine" matter. Therefore, if you are a beneficial owner of shares registered in the name of your broker or other nominee and you fail to provide instructions to your broker or nominee as to how to vote your shares on this proposal, your broker or nominee will have the discretion to vote your shares on such proposal. Accordingly, if you fail to provide voting instructions to your broker or nominee, your broker or nominee can vote your shares on the proposal in a manner that is contrary to what you intend. For example, if you are against the approval of Proposal 2 but you do not provide any voting instructions to your broker, your broker can nonetheless vote your shares "For" Proposal 2. While we do not expect any broker non-votes on either Proposal 2, if you do not provide voting instructions and your broker or nominee fails to vote your shares, this will not have any effect on the approval of Proposal 2.If you are a beneficial owner of shares registered in the name of your broker or other nominee, we strongly encourage you to provide voting instructions to the broker or nominee that holds your shares to ensure that your shares are voted in the manner in which you want them to be voted.

If you hold shares in street name and want to voteparticipate in person at the virtual Annual Meeting, you will need to ask your bank, broker or custodian to provide you with a valid legal proxy. You will need to bring the proxy with you to the Annual Meeting in order to vote. Please note that if you requestmust first obtain a legal proxy from your broker, bank broker or custodian, any previously executed proxy willother nominee reflecting the number of shares you held as of the record date, your name and email address. You then must submit a request for registration to our transfer agent, AST: (1) by email to proxy@astfinancial.com; (2) by facsimile to 718-765-8730 or (3) by mail to American Stock Transfer & Trust Company, LLC, Attn: Proxy Tabulation Department, 6201 15th Avenue, Brooklyn, NY 11219. Requests for registration must be revokedlabeled as "Legal Proxy" and your vote will not be counted unless you vote in person at the Annual Meeting or appoint another valid legal proxy to votereceived by AST no later than 5:00 p.m. EDT on your behalf.May 27, 2020.

Can I change my vote? |

Yes. If you are a record holder, you may:

If you hold your shares in street name, you may:

4 Notice of 20192020 Annual Meeting of Stockholders and Proxy Statement

INFORMATION ABOUT THE |

Who will count the votes? Is my vote confidential? |

A representative of our transfer agent, AST, has been appointed Inspector of Election for the Annual Meeting. The Inspector of Election will determine the number of shares outstanding, the shares represented at the Annual Meeting, the existence of a quorum, and the validity of proxies and ballots, and will count all votes and ballots.

All votes are confidential. Your voting records will not be disclosed to us, except as required by law, in contested Board elections or certain other limited circumstances.

Who pays for the proxy solicitation and how will Neos solicit votes? |

We pay the cost of preparing our proxy materials and soliciting your vote. Proxies may be solicited on our behalf by our directors, officers, employees and agents by telephone, electronic or facsimile transmission or in person. We may choose to enlist the help of banks and brokerage houses in soliciting proxies from their customers and, in all cases, will reimburse them for their related out-of-pocket expenses.

Where can I find the voting results of the Annual Meeting? |

We will publish the voting results of the Annual Meeting on a Current Report on Form 8-K filed with the SEC. The Form 8-K will be available online atwww.sec.gov within four business days following the end of our Annual Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the Special Meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

IMPORTANT INFORMATION IF YOU PLAN TO ATTEND THE VIRTUAL ANNUAL MEETING IN PERSON

You must be ableDue to show that you owned Neos common stock onrising concerns around the record date, April 23, 2019,spread of COVID-19 in order to gain admission to the Annual Meeting. Please bring toUnited States and globally, the Annual Meeting will be a virtual stockholder meeting through which you can listen to the notice of Internet availability of proxy materials, a printedmeeting and vote online. The Annual Meeting can be accessed by visiting https://web.lumiagm.com/266220294 (password: neos2020) on June 10, 2020, using the 11-digit control number included on the proxy card or a brokerage statement or letter from your broker verifying ownership of Neos shares as of April 23, 2019. You also must bring a valid government-issued photo ID. Registration will begin at 7:30 a.m.Please notemailed to you. We recommend that you are not permitted to bring any cameras, recording equipment, electronic devices, large bags, briefcases or packages intolog in a few minutes before the Annual Meeting.Meeting begins at 8:00 a.m. CDT to ensure you are logged in when the meeting starts.

| | |

| | Notice of |

CORPORATE GOVERNANCE |

GOVERNANCE POLICIES AND PRACTICES

Neos is committed to ensuring strong corporate governance practices on behalf of our stockholders. Neos' Corporate Governance Guidelines, together with the charters of the Audit, Compensation and Nominating and Corporate Governance Committees, establishes a framework of policies and practices for our effective governance and to assist and guide each director in the exercise of his or her responsibilities. Our Corporate Governance Guidelines, which are available at http://investors.neostx.com, address Board composition, leadership, performance and compensation, director qualifications, director independence, committee structure and roles, and succession planning, among other things. The Board, the Nominating and Corporate Governance Committee and the other committees regularly review their governance policies and practices and developments in corporate governance and update these documents, including the Corporate Governance Guidelines, as they deem appropriate for Neos.

The following describes some of our most significant governance practices by area.

BOARD STRUCTURE AND PROCESS ✓ 8 Directors on Board ✓ 7 Independent Directors (88%) ✓ Classified Board Divided into Three Classes ✓ Diverse Board as to Composition, Skills and Experience ✓ Independent Chairman of the Board ✓ Independent Audit, Compensation, and Nominating and Corporate Governance Committees ✓ Annual Evaluations of the Board and its Committees | OVERSIGHT OF EXECUTIVE COMPENSATION ✓ Pay-for-Performance Executive Compensation Philosophy ✓ No Tax Gross-up ✓ Provide for Double-Trigger Change in Control Arrangements ✓ No Excessive Perquisites ✓ Target Pay Based on Market Norms

|

ALIGNMENT WITH STOCKHOLDER INTERESTS ✓ High Percentage of Variable ("at risk") NEO Pay ✓ Significant Portion of Director Compensation Delivered in Neos Common Stock ✓ Restrictions on Hedging and Pledging of Neos Common Stock ✓ No repricing of stock options without stockholder approval |

For more information about our executive compensation governance policies and practices, see Executive Compensation beginning on page 27.28.

6 Notice of 20192020 Annual Meeting of Stockholders and Proxy Statement

CORPORATE GOVERNANCE(CONTINUED) |

ROLE OF THE BOARD AND LEADERSHIP STRUCTURE

The Board's primary role is the oversight of the management of Neos' business affairs and assets in accordance with the Board's fiduciary duties to stockholders under Delaware law. To fulfill its responsibilities to our stockholders, Neos' Board, both directly and through its committees, regularly engages with management, promotes management accountability and reviews the most critical issues that face Neos. Among other things, the Board reviews the Company's strategy and mission, its execution on financial and strategic plans, and succession planning. The Board also oversees risk management and determines the compensation of the President and Chief Executive Officer (CEO), in consultation with the Compensation Committee. All directors play an active role in overseeing the Company's business strategy at the Board and committee levels. The Board is committed to meeting the dynamic needs of the Company and focusing on the interests of its stockholders and, as a result, regularly evaluates and adapts its composition, role, and relationship with management.

Independent Board Members |

Neos believes in the importance of a board comprised largely of independent, non-employee directors. Currently, the Board has determined that all Neos directors, other than the Company's CEO, Gerald McLaughlin, are independent under Nasdaq listing standards and SEC rules. Similarly, at the committee level, all committee members are independent under Nasdaq listing standards and SEC rules applicable to each committee.

Independent Chairman of the Board |

We have separated the roles of the Chairman of the Board and CEO, and have appointed Alan Heller, to serve as our independent Chairman. We believe that having a Chairman separate from the CEO helps to ensure greater independent oversight of the Company and the management team and contributes to strong governance practices. The Board regularly assesses the appropriateness of this leadership structure and has concluded that this structure is appropriate for Neos at this time. The full Board evaluates the Chairman's performance on an annual basis.

The following table describes the key responsibilities that the Board has entrusted to the Chairman of the Board:

| CHAIRMAN RESPONSIBILITIES | ||

· Serves as principal representative of the Board · Develops schedule and agenda of Board meetings, in consultation with the CEO and other directors · Presides over Board meetings · Facilitates discussion among independent directors on key issues | · Acts as a liaison between the Board and management · Advises the CEO on issues of concern for the Board · Engages in the director recruitment process · Represents the Company in interactions with external stakeholders, at the request of the Board | |

| | |

| | Notice of |

CORPORATE GOVERNANCE(CONTINUED) |

Risk Oversight |

One of the Board's key functions is informed oversight of our risk management process and the specific risks that could affect us. The Board does not have a standing risk management committee, but rather administers this oversight function directly through the Board as a whole, as well as through various Board standing committees that address risks inherent in their respective areas of oversight. In particular, our Board is responsible for monitoring and assessing strategic risk exposure, including a determination of the nature and level of risk appropriate for the Company. Our Audit Committee has the responsibility to consider and discuss our major financial risk exposures and the steps our management has taken to monitor and control these exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken. The Audit Committee also monitors compliance with legal and regulatory requirements, in addition to oversight of the performance of our internal audit function. Our Nominating and Corporate Governance Committee monitors the effectiveness of our corporate governance guidelines, including whether they are successful in preventing illegal or improper liability-creating conduct. Our Compensation Committee assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk-taking. It is the responsibility of the committee chairs to report findings regarding material risk exposures to the Board as quickly as possible.

8 Notice of 20192020 Annual Meeting of Stockholders and Proxy Statement

CORPORATE GOVERNANCE(CONTINUED) |

Neos employs a number of other practices directed to ensure the highest level of corporate governance oversight on behalf of its stockholders. The following table describes some of these practices in more detail.

PRACTICES DIRECTED TO INDIVIDUAL NEOS DIRECTORS | ||||||

| | | | | | | |

| Limits on Public Company Directorships | The Board does not believe that its directors should be prohibited from serving on boards of other organizations. However, the Nominating and Corporate Governance Committee takes into account the nature of and time involved in a director's service on other boards in evaluating the suitability of individual directors and making its recommendations to the Board. The Company expects that each of its directors will be able to dedicate the time and resources sufficient to ensure the diligent performance of his or her duties on the Company's behalf, including attending Board and applicable committee meetings. | |||||

Change in Director's Principal Position | If a director changes his or her principal employment position, that director is required to notify the Nominating and Corporate Governance Committee. The Committee will then review the continued appropriateness of Board membership under the new circumstances. | |||||

Continuing Education for Directors | The Board is regularly updated on Neos' businesses, strategies, operations and employee matters, as well as external trends and issues that affect the Company. The Nominating and Corporate Governance Committee oversees the continuing education process and it encourages directors to attend continuing education courses relevant to their service on Neos' Board. Neos will reimburse directors for expenses they incur in connection with continuing education courses. | |||||

Attendance at Annual Meeting of Stockholders | The Board encourages all directors and nominees for director to attend the Annual Meeting. In | |||||

| | | | | | | |

| | |

| | Notice of |

CORPORATE GOVERNANCE(CONTINUED) |

PRACTICES DIRECTED TO NEOS BOARD PROCESSES | ||||||

| | | | | | | |

| Board Executive Sessions | As part of all regularly scheduled Board meetings, the Chairman presides over all executive sessions of the Board, including those sessions held solely with independent directors. At each regularly scheduled meeting held in | |||||

Director Access to Management | Independent directors have unfettered access to members of senior management and other key employees. | |||||

Independent Advisors | The Board and its committees are able to access and retain independent advisors as and to the extent they deem necessary or appropriate. | |||||

Management Succession Planning | At the direction of the Board, the Nominating and Corporate Governance Committee oversees management succession planning. As appropriate, the Nominating and Corporate Governance Committee will develop and approve succession plans for the Company's CEO and review succession plans for the Company's CEO and senior management with the Board. | |||||

Annual Board Evaluation | Each year, the Nominating and Corporate Governance Committee oversees the evaluation of the Board, its committees and the directors. Each Board committee also is responsible for conducting a self-assessment to identify potential areas of improvement. On an ongoing basis, directors offer suggestions and recommendations intended to further improve Board performance. | |||||

| | | | | | | |

PRACTICES DIRECTED TO NEOS STOCKHOLDERS | ||||||

| | | | | | | |

| Alignment of Director Compensation | The Compensation Committee periodically reviews and recommends to the Board the type and level of non-employee director compensation. Neos endeavors to deliver a significant portion of its non-employee director compensation in the form of options to purchase Neos common stock. For more information on non-employee director compensation, see page | |||||

No Stockholder Rights Plan | Neos does not have a stockholder rights | |||||

Anti-hedging and Anti-pledging Policies | Our insider trading policy prohibits directors, executive officers, and employees from buying and selling derivatives on our securities or obtaining an opportunity, directly or indirectly, to profit from any change in the value of our securities, engaging in any other hedging transactions with respect to our securities, or holding our securities in a margin account. In addition, our securities may not be pledged as collateral for a loan without the prior approval of the Audit Committee. To date, no such requests have been made or approved. | |||||

| | | | | | | |

10 Notice of 20192020 Annual Meeting of Stockholders and Proxy Statement

CORPORATE GOVERNANCE(CONTINUED) |

In 2018,2019, there were sevenfive meetings of the Board, fourfive meetings each of the Audit andCommittee, three meetings of the Nominating and Corporate Governance, committees of the Board, threeand six meetings of the Compensation Committee, and one meeting of a special purpose committee of the Board.Committee. Overall director attendance at Board and committee meetings in 20182019 was approximately 97%95%. Each director attended 87%92% or more of the aggregate of all meetings of the Board and committees on which he or she served during 2018.2019, with the exception of Linda Szyper who attended 71%. In addition to formal Board meetings, the Board engages with management throughout the year on critical matters and topics.

The Board has the three standing committees: Audit, Compensation, and Nominating and Corporate Governance. In its discretion and subject to Delaware law, the Board and each committee may delegate all or a portion of its authority to subcommittees of one or more of its members. Additional information can be found in the committee charters adopted by the Board and available on Neos' website at http://investors.neostx.com. Each committee member meets the independence standards and other qualifications required for the committee on which he or she serves.

NOMINATING AND CORPORATE Chair: Beth Hecht Other Committee Members: James Robinson (from January 29, 2019), Alan Heller (until January 29, 2019), John Schmid, Linda Primary Responsibilities: • Assisting the Board by identifying qualified candidates for director, assessing director independence and recommending to the Board the director nominees. • Making recommendations to the Board regarding the composition, organization and governance of the Board, including recommendations regarding the membership and chairperson of each Board committee. • Reviewing, advising and reporting to the Board on the Board's membership, structure, organization, governance practices and performance. • Developing, recommending and maintaining a set of Corporate Governance Guidelines applicable to the Company. • Overseeing the annual review and evaluation of the Board and its committees, including individual directors.

| COMPENSATION COMMITTEE Chair: Greg Robitaille Other Committee Members: Bryant Fong, Linda Szyper, Primary Responsibilities: • Overseeing the Company's overall compensation structure, policies and programs. • Reviewing the corporate goals and objectives relevant to the compensation of the CEO and CFO, evaluating the CEO's performance in light of these goals and objectives and, based on this review and evaluation, recommending the compensation of the CEO and CFO to the independent members of the Board for approval. • Reviewing and approving the compensation of the Company's executive officers and key senior management, other than the CEO and CFO. • Supervising the administration of the Company's equity incentive plans and approving equity compensation awards pursuant to these plans. • Maintaining direct responsibility for the appointment, compensation and oversight of the work of any compensation consultant, legal counsel or other external adviser retained by the Committee.

|

| | |

| | Notice of |

CORPORATE GOVERNANCE(CONTINUED) |

Chair: John Schmid

Other Committee Members: Bryant Fong, Greg Robitaille

Primary Responsibilities:

Financial Expertise and Financial Literacy:

The Board has determined that Mr. Schmid is an "audit committee financial expert" as defined in the SEC rules, and all members of the Audit Committee are financially literate within the meaning of the Nasdaq listing standards.

The current Board includes seven non-employee directors. To be independent under Nasdaq listing standards, the Board must affirmatively determine that a director has no material relationships with the Company directly, or as an officer, stockholder or partner of an organization that has a relationship with the Company (a "Material Relationship"). In making its assessment, the Board considers all relevant facts and circumstances, including whether transactions with such organizations are in the ordinary course of Neos' business and/or the amount of such transactions (in aggregate or as a percentage of the organization's revenues or assets). The Board also considers that the Company may sell products and services to, and/or purchase products and services from, organizations affiliated with our directors and may hold investments (generally, debt securities) in organizations affiliated with our directors. On an annual basis, the Board, through its Nominating and Corporate Governance Committee, reviews relevant relationships between directors, their immediate family members and the Company, consistent with Neos' independence standards. Neos' standards conform to the independence requirements set forth in the Nasdaq's listing standards.

The Board consults with our counsel to ensure that the Board's determinations are consistent with relevant securities and other laws and regulations regarding the definition of "independent," including those set forth in pertinent Nasdaq listing standards.

Based on its review of director relationships, the Board has affirmatively determined that there are no Material Relationships between the non-employee directors and the Company and each of the non-employee directors is independent as defined in both the Nasdaq listing standards (including those applicable to certain board committees) and Neos' director independence standards.

12 Notice of 20192020 Annual Meeting of Stockholders and Proxy Statement

CORPORATE GOVERNANCE(CONTINUED) |

Neos is committed to integrity, legal compliance and ethical conduct. All directors and employees, including our executive officers, must comply with the Company's Code of Business Conduct and Ethics. The Code of Business Conduct and Ethics and Neos' related policies and procedures address major areas of professional conduct, including, among others, conflicts of interest, protection of private, sensitive or confidential information, employment practices, insider trading and adherence to laws and regulations affecting the conduct of Neos' business. The Code of Business Conduct and Ethics is available on our website at http://investors.neostx.com. We intentintend to disclose any amendments to the Code of Business Conduct and Ethics, or any waivers of its requirements, on our website.

The Code of Business Conduct and Ethics requires all directors and employees to avoid any conflict or potential conflict between their personal interests (including those of their significant others and immediate family) and the best interests of the Company. Any conflict or potential conflict must be brought to the attention of the Compliance Officer for review and disposition. In addition, directors and officers cannot participate in a personal transaction with Neos without first notifying and obtaining the approval of the Audit Committee in accordance with the Company related person transaction policy described below.

Transactions with Related Persons |

Neos has adopted a written policy that sets forth our procedures for the identification, review, consideration and approval or ratification of related person transactions. For purposes of our policy only, a related person transaction is a transaction between us and related persons in which the aggregate amount involved exceeds or may be expected to exceed $120,000 and in which a related person has or will have a direct or indirect material interest. Transactions involving compensation for services provided to us as an employee or director are not covered by this policy. A related person is any executive officer, director, nominee for director, or beneficial owner of more than 5% of any class of our common stock, including any of their immediate family members, in each case since the beginning of our most recently completed fiscal year. Pursuant to this policy, the Audit Committee will review the material facts of all related party transactions. The Audit Committee will take into account whether the related party transaction is on terms no less favorable to us than terms generally available in a transaction with an unrelated third party under the same or similar circumstances and the extent of the related party's interest in the related party transaction.

Based on this review and except as disclosed below, there are no related person transactions requiring disclosure under SEC rules.

Agreements with Our Stockholders

In connection with certain preferred stock financings that occurred prior to our initial public offering, we entered into an investors' rights agreement with certain purchasers of our redeemable convertible preferred stock. Our amended and restated investors' rights agreement, or Investor Rights Agreement, provides certain holders of our capital stock, including one of our directors, with the right to demand that we file a registration statement, subject to certain limitations, and to request that their shares be covered by a registration statement that we are otherwise filing. These rights terminate for a holder upon the earlier of (a) such time as Rule 144 or another similar exemption under the Securities Act is available for the sale of all of such holder's shares without limitation during a three-month period without registration, and (b) the fifth anniversary of our initial public offering.

| | |

| | Notice of |

CORPORATE GOVERNANCE(CONTINUED) |

Compensation Committee Interlocks and Insider Participation |

During 2018,2019, the members of our Compensation Committee were Greg Robitaille, Bryant Fong, James Robinson, and Linda Szyper and Paul Edick.Szyper. None of our directors who currently serve as members of our Compensation Committee is or, has at any time during the past year, has been one of our officers or employees. None of our executive officers currently serves, or in the past year has served, as a member of the Board of Directors or Compensation Committee of any other entity that has one or more executive officers serving on our Board of Directors or Compensation Committee.

14 Notice of 20192020 Annual Meeting of Stockholders and Proxy Statement

PROPOSAL 1. ELECTION OF DIRECTORS |

The Board of Directors is elected by Neos' stockholders and is divided into three classes, each with a three-year term. There are currently eight members of the Board. Vacancies on the Board may be filled only by persons elected by a majority of the remaining directors. A director elected by the Board to fill a vacancy in a class, including vacancies created by an increase in the number of directors, shall serve for the remainder of the full term of that class and until the director's successor is duly elected and qualified.

At the Annual Meeting, the Board is nominating for election by stockholders threetwo Class III directors, each of whom currently is a director of the Company. If elected at the Annual Meeting, each of these nominees would serve until the 20222023 Annual Meeting of Stockholders and until her or his successor has been duly elected and qualified, or, if sooner, until the director's death, resignation, or removal.

The role of the Board, its leadership structure and governance practices are described above in the Corporate Governance section. This section describes the process for director elections and director nominations, identifies the director responsibilities and qualifications considered by the Board and the Nominating and Corporate Governance Committee in selecting and nominating directors, and presents the biographies, skills and qualifications of the director nominees and those directors continuing in office.

PROCESS FOR SELECTING AND NOMINATING DIRECTORS

The Board has delegated the director selection and nomination process to the Nominating and Corporate Governance Committee, with the expectation that other members of the Board, and of management, will be requested to take part in the process, as appropriate. The Nominating and Corporate Governance Committee may retain a third-party search firm to assist in identifying and evaluating candidates for Board membership. The Nominating and Corporate Governance Committee also considers suggestions for Board nominees submitted by stockholders, which are evaluated using the same criteria as new director candidates and current director nominees. Instructions for how to submit stockholder nominations to the Board can be found on page 41.

Generally, the Nominating and Corporate Governance Committee identifies candidates for director nominees in consultation with management, through the use of search firms or other advisors, through the recommendations submitted by stockholders or through such other methods as the nominating and corporate governance committee deems to be helpful to identify candidates. Once candidates have been identified, the Nominating and Corporate Governance Committee confirms that the candidates meet all of the minimum qualifications for director nominees established by the nominating and corporate governance committee. The Nominating and Corporate Governance Committee may gather information about the candidates through interviews, detailed questionnaires, comprehensive background checks or any other means that the Nominating and Corporate Governance Committee deems to be appropriate in the evaluation process. The Nominating and Corporate Governance Committee then meets to discuss and evaluate the qualities and skills of each candidate, both on an individual basis and taking into account the overall composition and needs of the Board. Based on the results of the evaluation process, the Nominating and Corporate Governance Committee recommends candidates for the Board's approval as director nominees for appointment or election to the Board.

In evaluating proposed director candidates, the Nominating and Corporate Governance Committee may consider all facts and circumstances that it deems appropriate or advisable, including, among other things, the skills of the proposed director candidate, his or her depth and breadth of professional experience or other background characteristics, his or her independence, the current size and composition of our Board and the needs of our Board and its respective committees. Some of the qualifications that the Nominating and Corporate Governance Committee considers include, without

| | |

| | Notice of |

PROPOSAL 1. ELECTION OF DIRECTORS(CONTINUED) |

limitation, integrity, judgment, diversity of experience, expertise, business acumen, understanding of our business and industry, potential conflicts of interest and other commitments. Nominees must also have proven achievement and competence in their field and the ability to provide guidance to our management team and make significant contributions to our success, and an understanding of the fiduciary responsibilities that are required of a director. Director candidates must have sufficient time available in the judgment of our nominating and corporate governance committee to perform all board of director and committee responsibilities. Members of our Board are expected to prepare for, attend, and participate in all Board and, as applicable, Board committee meetings.

While we do not have a specific policy with regard to the consideration of diversity in identifying director nominees, in identifying and evaluating proposed director candidates, we value diversity of perspective and the nominating and corporate governance committee considers, in addition to the minimum qualifications and other criteria for Board membership approved by the Board from time to time, whether, if elected, the nominee assists in achieving a mix of board members that represents a diversity of race, ethnicity, gender, age, background, and professional experience.

Upon the recommendation of the Nominating and Corporate Governance Committee, the Board is nominating the threetwo Class III directors listed below for election for terms expiring at the 20222023 Annual Meeting of Stockholders. All nominees have consented to serve, and the Board does not know of any reason why any nominee would be unwilling or unable to serve. If a nominee becomes unavailable or unable to serve before the Annual Meeting, the Board may reduce its size or designate another nominee. If the Board designates a nominee, your proxy will be voted for the substitute nominee.

Below are biographies, skills and qualifications for each of the nominees and for each of the directors continuing in office. Each of the director nominees currently serves on the Board. The Board believes that the combination of the various experiences, skills and qualifications represented contributes to an effective and well-functioning Board and that the nominees and directors continuing in office possess the qualifications, based on the criteria described above, to provide meaningful oversight of Neos' business and strategy. In addition to the information presented below regarding each such person's specific experience, qualifications, attributes and skills, we also believe that each of our directors has a reputation for integrity, honesty and adherence to high ethical standards. Each of our directors has demonstrated business acumen and an ability to exercise sound judgment, as well as a commitment of service to Neos and our Board. Finally, we value our directors' experience in relevant areas of business management and on other boards of directors and board committees.

16 Notice of 20192020 Annual Meeting of Stockholders and Proxy Statement

PROPOSAL 1. ELECTION OF DIRECTORS(CONTINUED) |

The Board of Directors unanimously recommends that stockholders vote FOR the nominees listed below.

| | Gerald McLaughlin | |

| | | |

| Management Director Since: 2018 Age: 52 Board Committee(s): • None | Mr. McLaughlin was appointed President, Chief Executive Officer, and member of our Board of Directors in June 2018. From June 2014 until June 2018, he was President and Chief Executive Officer of AgeneBio, a CNS biopharmaceutical company. Prior to this, Mr. McLaughlin served as the Senior Vice President and Chief Commercial Officer of NuPathe Inc. from September 2007 until its acquisition by Teva Pharmaceuticals Industries Ltd. in March 2014. Previously, Mr. McLaughlin was at Endo Pharmaceuticals from 2001 to 2007 and served in a variety of commercial leadership roles at Merck from 1990 to 2001. He holds a B.A. in Economics from Dickinson College and an M.B.A. from Villanova University. | |

| | Greg Robitaille | |

| | | |

| Independent Director Since: 2009 Age: 56 Board Committee(s): • Audit • Compensation (Chair) | Mr. Robitaille has managed Corporate Development activities at Water Street Healthcare Partners since July 2011. Mr. Robitaille also spent 10 years with Equity Group Investments, the primary investment company of Sam Zell. Mr. Robitaille holds a B.A. from Hamilton College and an M.B.A. from Columbia University. | |

| | |

| | Notice of 2020 Annual Meeting of Stockholders and Proxy Statement 17 |

PROPOSAL 1. ELECTION OF DIRECTORS(CONTINUED) |

CLASS III DIRECTORS WHO WILL CONTINUE IN OFFICE UNTIL THE 2021 ANNUAL MEETING

| | Beth Hecht | |

| | | |

| Independent Director Since: 2015 Age: 56 Board Committee(s): • Nominating and Corporate Governance (Chair) | Since January 2019, Ms. Hecht has served as Senior Vice President, General Counsel and Corporate Secretary of Xeris Pharmaceuticals, Inc. (NASDAQ: XERS) and she served as General Counsel and Corporate Secretary of Xeris on a part-time basis from January 2018 to December 2018. From October 2012 through December 2018, Ms. Hecht served as Managing Director and Chief Legal and Administrative Officer of Auven Therapeutics. From November 2013 through November 2014, Ms. Hecht also served as Corporate Secretary and Legal and Compliance Advisor at Durata Therapeutics Inc., which merged with Actavis plc in November 2014. Prior to that, she was Senior Vice President, General Counsel and Corporate Secretary at the Sun Products Corporation from March 2009 through September 2012, and prior to that Executive Vice President and General Counsel of MedPointe Inc. Ms. Hecht received a J.D. from Harvard Law School and a B.A. from Amherst College. | |

18 Notice of 2020 Annual Meeting of Stockholders and Proxy Statement

PROPOSAL 1. ELECTION OF DIRECTORS(CONTINUED) |

| | John Schmid | |

| | | |

| Independent Director Since: 2015 Age: 57 Board Committee(s): • Audit (Chair) • Nominating and Corporate Governance | Mr. Schmid served as Chief Financial Officer of Auspex Pharmaceuticals, Inc., a publicly traded biotechnology company, from September 2013 until its sale to Teva Pharmaceuticals, Inc. (NYSE: TEVA) in June 2015. Prior to that, he co-founded Trius Therapeutics, Inc., where he served as Chief Financial Officer from June 2004 until its sale to Cubist Pharmaceuticals, Inc. in September 2013. Mr. Schmid also served as Chief Financial Officer at GeneFormatics, Inc. from 1998 to 2003 and as Chief Financial Officer at Endonetics, Inc. from 1995 to 1998. He currently serves on the board of directors and as chairman of the audit committee of AnaptysBio, Inc. (NASDAQ: ANAB) and Xeris Pharmaceuticals, Inc. (NASDAQ: XERS), and on the board of directors of Forge Therapeutics, Poseida Therapeutics, and Speak, Inc. Mr. Schmid holds a B.A. in Economics from Wesleyan University and an M.B.A. from the University of San Diego. | |

| | Linda M. Szyper | |

| | | |

| Independent Director Since: 2018 Age: 54 Board Committee(s): • Compensation • Nominating and Corporate Governance | Ms. Szyper has served as the Chief Operating Officer at McCann Health since January 2018. From January 2017 to December 2017, she served as Managing Partner of 3G Advisors, LLC. From September 2014 to December 2016, Ms. Szyper was the Chief Commercial Officer and President, US Operations at Circassa Pharmaceuticals plc. Prior to this, Ms. Szyper was the Chief Development Officer at Publicis Healthcare Group from January 2008 to September 2014. Ms. Szyper holds a M.B.A. from DePaul University's Kellstadt Graduate School of Business and a Bachelor of Science in biomedical engineering from Northwestern University. | |

| | |

| | Notice of 2020 Annual Meeting of Stockholders and Proxy Statement 19 |

PROPOSAL 1. ELECTION OF DIRECTORS(CONTINUED) |

CLASS I DIRECTORS WHO WILL CONTINUE IN OFFICE UNTIL THE 2022 ANNUAL MEETING

| | Alan Heller | |

| | | |

| Independent Chairman of the Board Director Since: 2009 Age: Board Committee(s): • None | Mr. Heller has been an Operating Partner at Water Street Healthcare Partners, LLC, since January 2006. Mr. Heller was President and CEO of American Pharmaceutical Partners from October 2004 until November 2005, and prior to that was Corporate Vice President and President Global Renal at Baxter International from September 2000 until January 2004. Earlier, Mr. Heller served as President of Searle Operations at the time of its integration with Pharmacia Corporation. He currently serves as Chairman of the boards of directors of privately-held Capstone Development, Inc., Custopharm, Inc., and Long Grove Pharmaceuticals, LLC. Mr. Heller holds an M.B.A. from DePaul University and a B.S. from the University of Illinois, Chicago. | |

| | Bryant Fong | |

| | | |

| Independent Director Since: Age: Board Committee(s): • Audit • Compensation | Since October 2013, Mr. Fong has served as founding General Partner at Biomark Capital, LLP, a life sciences venture capital fund. Prior to Biomark Capital, Mr. Fong was a Managing Director at Burrill & Company, from 1998 to 2013. Mr. Fong | |

20 Notice of 2020 Annual Meeting of Stockholders and Proxy Statement |

|

|

|

|

|

PROPOSAL 1. ELECTION OF DIRECTORS(CONTINUED) |

| | James Robinson | |

| | | |

| Independent Director Since: 2019 Age: Board Committee(s): • Compensation • Nominating and Corporate Governance | Mr. Robinson has served as the President and Chief Executive Officer of Urovant Sciences Ltd. (NASDAQ: UROV) since March 2020 and a member of its board of directors since March 2019. From April 2019 until March 2020, Mr. Robinson served as the President and Chief Operating Officer of Paragon Biosciences, | |

CLASS II DIRECTORS WHO WILL CONTINUE IN OFFICE UNTIL THE 2020 ANNUAL MEETING

|

| |

18 Notice of 2019 Annual Meeting of Stockholders and Proxy Statement

|

|

| |

CLASS III DIRECTORS WHO WILL CONTINUE IN OFFICE UNTIL THE 2021 ANNUAL MEETING

|

| |

| | |

| | Notice of |

|

|

| |

|

| |

20 Notice of 2019 Annual Meeting of Stockholders and Proxy Statement

NON-EMPLOYEE DIRECTOR COMPENSATION |

The Compensation Committee reviews and makes recommendations to the Board about the compensation paid to non-employee directors for service on the Neos Board of Directors. A director who also is an employee of the Company does not receive payment for services as a director. The CEO is the only employee who currently serves as a director.

The Board believes that the current director compensation program:

The program is designed to enable us to attract and retain, on a long-term basis, highly qualified non-employee directors.

The Compensation Committee's charter provides that it will periodically review director compensation and recommend any changes to the Board for its approval. The Compensation Committee may from time to time engage an independent compensation consultant to assist in its review of director compensation.

The Board has approved the non-employee director compensation program set forth below.

Annual Cash Compensation |

The following chart summarizes the cash retainer compensation provided to non-employee directors for their ongoing service on the Neos Board during 2018.2019. Cash payments are made in equal, monthly installments.

| | | | | | | | | |

| Retainer Type | Annual Amount | | |||||

| Board member | $35,000 | ||||||

| Board chair (additional retainer) | $25,000 | | |||||

| Committee member | |||||||

| • | Audit | $7,500 | |||||

| • | Compensation | $5,000 | |||||

| • | Nominating and Corporate Governance | $3,750 | |||||

| Committee chair (in lieu of Committee member fee) | | | |||||

| • | Audit | $15,000 | | ||||

| • | Compensation | $10,000 | | ||||

| • | Nominating and Corporate Governance | $10,000 | | ||||

| | | | | | | | | |

22 Notice of 2020 Annual Meeting of Stockholders and Proxy Statement

NON-EMPLOYEE DIRECTOR COMPENSATION(CONTINUED) |

Equity Compensation |

The equity compensation awards to non-employee directors are made under the 2015 Stock Option and Incentive Plan, as amended (the "2015 Equity Plan"). All stock options granted to directors are

|

|

|

|

|

|

|

nonstatutory stock options, with an exercise price per share equal to the closing price of the underlying common stock on the Nasdaq Global Market on the date of grant, and a term of ten years from the date of grant (subject to earlier termination in connection with a termination of service as provided in the 2015 Equity Plan).

DIRECTOR COMPENSATION TABLE FOR 20182019

The table below includes information about the compensation paid to non-employee directors in 2018. Mr. Robinson joined the Board in January 2019 and, therefore, is not included in this table.2019.

| | | | | | | | | | | | | | | | | | | | | |

| | Name | Fees Earned or Paid in Cash ($) | Option Awards(1)(2) ($) | Total Compensation ($) | | Name | Fees Earned or Paid in Cash ($) | Option Awards(1)(2) ($) | Total Compensation ($) | |||||||||||

| Paul Edick3 | 14,580 | - | 14,580 | Bryant Fong | 47,500 | 38,000 | 85,500 | |||||||||||||

| | Bryant Fong | 47,500 | 75,190 | 122,690 | | Beth Hecht | 45,000 | 38,000 | 83,000 | | ||||||||||

| Beth Hecht | 45,000 | 75,190 | 120,190 | Alan Heller | 60,625 | 38,000 | 98,625 | |||||||||||||

| | Alan Heller | 63,750 | 75,190 | 138,940 | | James Robinson3 | 39,792 | 52,064 | 91,856 | | ||||||||||

| Greg Robitaille | 52,500 | 75,190 | 127,690 | Greg Robitaille | 52,500 | 38,000 | 90,500 | |||||||||||||

| | John Schmid | 53,750 | 75,190 | 128,940 | | John Schmid | 53,750 | 38,000 | 91,750 | | ||||||||||

| Linda M. Szyper4 | 29,170 | 133,757 | 162,927 | Linda M. Szyper | 43,750 | 38,000 | 81,750 | |||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

Fees Earned or Paid in Cash

22 Notice of 2019

| | |

| | Notice of 2020 Annual Meeting of Stockholders and Proxy Statement 23 |

NON-EMPLOYEE DIRECTOR COMPENSATION(CONTINUED) |

Fees Earned or Paid in Cash

Option Awards

This column lists the aggregate grant date fair value of options awarded to non-employee directors in 20182019 pursuant to the non-employee director compensation program, computed in accordance with Financial Accounting Standards Board ("FASB"), Accounting Standards Codification ("ASC") Topic 718, applying the same model and assumptions that Neos applies for financial statement reporting purposes as described in Note 1314 to Neos' financial statements contained in its Annual Report on Form 10-K for the year ended December 31, 20182019 (disregarding any estimated forfeitures related to service-based vesting).

|

|

|

|

|

24 Notice of 2020 Annual Meeting of Stockholders and Proxy Statement |

PROPOSAL 2. RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS |

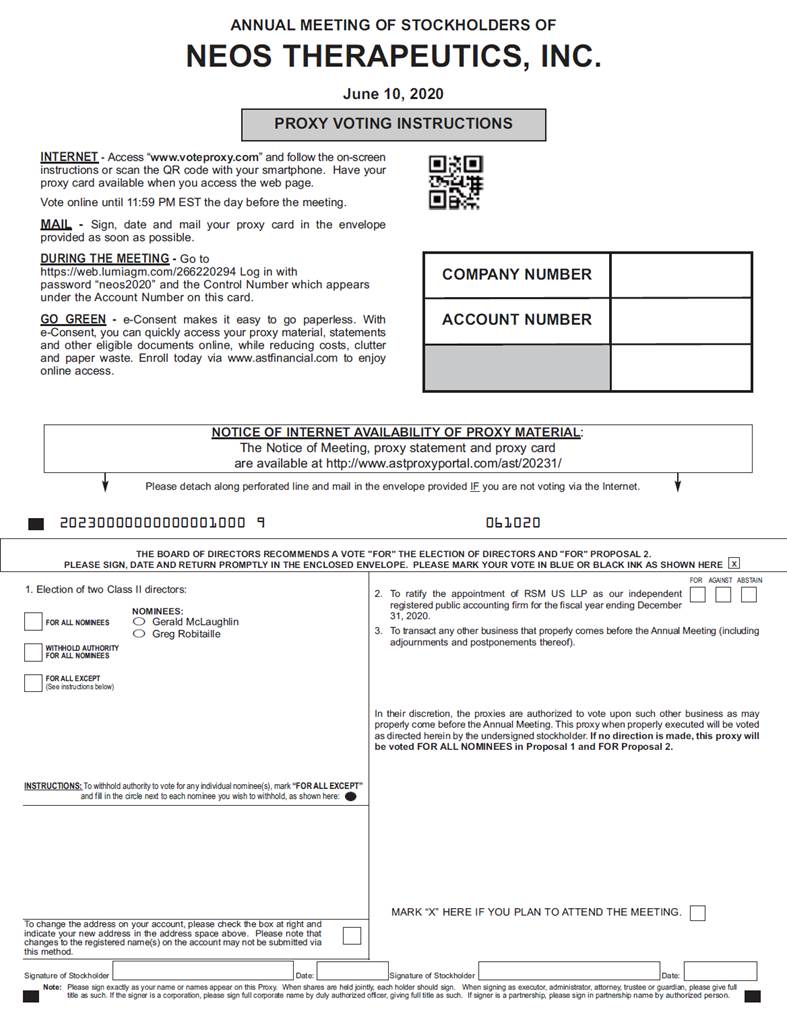

The Audit Committee is directly responsible for the appointment, compensation, retention and oversight of the independent registered public accounting firm retained to audit the Company's financial statements. The Audit Committee approved the appointment of RSM US LLP as Neos' independent registered public accounting firm for the fiscal year ending December 31, 2019.2020.

The Audit Committee and the Board believe that the continued retention of RSM US LLP to serve as the Company's independent registered public accounting firm is in the best interests of the Company and its stockholders. As a matter of good corporate governance, the Board is seeking stockholder ratification of the appointment even though ratification is not legally required. If stockholders do not ratify this appointment, the Audit Committee will reconsider RSM US LLP's appointment. Even if the selection is ratified, the Audit Committee in its discretion may select a different independent registered public accounting firm at any time of the year if it determines that such a change would be in the best interests of the Company and its stockholders.

A representative from RSM US LLP is expected to attend the Annual Meeting, may make a statement, and will be available to respond to appropriate questions.

The Board of Directors unanimously recommends that stockholders vote FOR the ratification of the appointment of RSM US LLP as Neos' independent registered public accounting firm for the fiscal year ending December 31, 20192020 as set forth in this Proposal 2.

Policy for the Pre-Approval of Audit and Permissible Non-Audit Services |

We have adopted a policy under which the Audit Committee pre-approves all audit and permissible non-audit services to be provided by the Company's independent registered public accounting firm, RSM US LLP. These services may include audit services, audit-related services, tax services, and other services. Pre-approval may also be given as part of the Audit Committee's annual approval of the scope of the engagement of the independent registered public accounting firm or on an individual explicit case-by-case basis before the independent registered public accounting firm is engaged to provide each service. In addition, in the event time constraints require pre-approval prior to the Audit Committee's next scheduled meeting, the Audit Committee has authorized its Chairperson to pre-approve services. Engagements so pre-approved are to be reported to the Audit Committee at its next scheduled meeting

In connection with this pre-approval policy, the Audit Committee also considers whether the categories of pre-approved services are consistent with the rules on accountant independence of the SEC and the Public Company Accounting Oversight Board. The Audit Committee has determined that the rendering of the services below by RSM US LLP is compatible with maintaining the principal accountant's independence.

| | |

| | Notice of 2020 Annual Meeting of Stockholders and Proxy Statement 25 |

24 Notice of 2019 Annual Meeting of Stockholders and Proxy Statement

PROPOSAL 2. RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS(CONTINUED) |

Fees to Independent Registered Public Accounting Firm |

Aggregate fees billed for professional services rendered by RSM US LLP for the audit of financial statements for the fiscal years ended December 31, 20182019 and December 31, 2017,2018, and fees billed for other services rendered by RSM US LLP during those periods were as follows (in thousands):

| | | | | | | | | | | | | | | | | |

| | 2018 | 2017 | | | 2019 | 2018 | | ||||||||

| Audit Fees | $435 | $446 | Audit Fees | $544 | $435 | ||||||||||

| Audit-related Fees | 106 | 78 | | Audit-related Fees | — | 106 | | ||||||||

| TOTAL | $541 | $524 | TOTAL | $544 | $541 | ||||||||||

| | | | | | | | | | | | | | ||||

|

|

|

|

|

26 Notice of 2020 Annual Meeting of Stockholders and Proxy Statement |

REPORT OF THE AUDIT COMMITTEE |

Neos maintains an independent Audit Committee that operates under a written charter adopted by the Board of Directors. The Audit Committee's charter is available on our website athttp://investors.neostx.com. All of the members of the Audit Committee are independent (as defined in SEC regulations and the listing standards of Nasdaq).

Neos' management has primary responsibility for preparing Neos' financial statements and establishing and maintaining financial reporting systems and internal controls. Management also is responsible for reporting on the effectiveness of Neos' internal control over financial reporting. The independent registered public accounting firm is responsible for performing an independent audit of Neos' financial statements and issuing a report on these financial statements. As provided in the Audit Committee's charter, the Audit Committee's responsibilities include oversight of these processes.

In this context, before Neos filed its Annual Report on Form 10-K for the year ended December 31, 20182019 (Form 10-K) with the SEC, the Audit Committee:

Based on the foregoing, the Audit Committee recommended to the Board of Directors that such audited financial statements be included in Neos' Annual Report on Form 10-K for the year ended December 31, 20182019 for filing with the SEC.

| AUDIT COMMITTEE: | ||

John Schmid, Chair Bryant Fong Greg Robitaille |

The material in this Report of the Audit Committee is not "soliciting material," is not deemed "filed" with the SEC and is not to be incorporated by reference in any filing of the Company under the Securities Act of 1933, as amended or the Securities Exchange Act of 1934, as amended, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

| | |

| | Notice of 2020 Annual Meeting of Stockholders and Proxy Statement 27 |

26 Notice of 2019 Annual Meeting of Stockholders and Proxy Statement

EXECUTIVE COMPENSATION |

Compensation Objectives |

Neos' pay-for-performance compensation philosophy has the following key objectives:

✓ Align the interests of the Company's executives with those of its stockholders and reward the creation of long-term value for Neos stockholders.

✓ Emphasize performance-based short-term and long-term compensation over fixed compensation.

✓ Motivate superior enterprise results with appropriate consideration of risk and while maintaining commitment to the Company's ethics and values.

✓ Reward the achievement of favorable long-term results more heavily than the achievement of short-term results.

✓ Provide market competitive compensation opportunities designed to attract, retain and motivate highly qualified executives.

While the Company's Board of Directors has the ultimate responsibility for risk oversight, the Compensation Committee oversees compensation-related risks, including with respect to the Company's corporate objectives and overall compensation design and awards. Specifically, the Compensation Committee seeks to ensure that Neos' compensation programs and policies do not encourage unnecessary or excessive risk-taking behavior by executives and do not create unreasonable risks.

To that end, our compensation programs are designed to encourage our executive officers and other employees to remain focused on the attainment of both the short-term and long-term strategic goals of the Company, as approved by the Board. Although a component of total compensation is performance-based, the Compensation Committee does not believe that the current program encourages unnecessary or excessive risk-taking or create risks that are likely to have a material adverse effect on the Company.

28 Notice of 2020 Annual Meeting of Stockholders and Proxy Statement |

|

|

|

|

|

EXECUTIVE COMPENSATION(CONTINUED) |

Executive Compensation Program Elements |

Neos' 20182019 executive compensation program consists of the following primary elements:

| | | | | | | |

| | Element | Description | | |||

| Base Salary | Represents the fixed portion of each executive's total direct compensation package. | |||||

Annual Cash Incentive | At-risk compensation based on performance. Annual incentive awards under the Cash Bonus Plan are based on the achievement of corporate results relative to pre-established performance goals, as adjusted for individual performance, accomplishments and contributions. | | ||||

Long-Term Incentives | At-risk compensation based on corporate performance. Equity incentive awards, including performance-based equity awards, ensure that executive officers are motivated over the long-term as owners and not just as employees, thereby aligning the executive officers' interests with those of stockholders. In accordance with Neos' compensation strategy, the predominant portion of an executive's compensation opportunity is tied to the long-term success of the Company. | |||||

Retirement Compensation | Neos provides retirement benefits that are aligned to competitive market practices, including a 401(k) plan for all eligible employees that provides for employee contributions as well as Company matching contributions of up to 4.0% of eligible pay. | | ||||

No Perquisites; Other Benefits | Our current executive officers do not receive any perquisites and are eligible for all benefits offered to Neos employees generally, including medical benefits, other health and welfare benefits, and other voluntary benefits. | |||||

| | | | | | | |

28 Notice of 2019 Annual Meeting of Stockholders and Proxy Statement

| | |

| | Notice of 2020 Annual Meeting of Stockholders and Proxy Statement 29 |

EXECUTIVE COMPENSATION(CONTINUED) |

20182019 SUMMARY COMPENSATION TABLE

This table includes information regarding 20182019 and 20172018 compensation for each of our CEO (and former CEO) and our two other most highly compensated executive officers in 2018,2019, which are referred to as the named executive officers, or NEOs. Other tables in this proxy statement provide more detail about specific types of compensation with respect to 2018.2019.

| | | | | | | | ||||||||||||||||||||||||||||||||||||||||||||

| | | | | | Non-Equity | All | | | | | | | | Non-Equity | All | | | ||||||||||||||||||||||||||||||||

| | | | | Stock | Option | Incentive Plan | Other | | | | | | | Stock | Option | Incentive Plan | Other | | | ||||||||||||||||||||||||||||||

| Name and Principal | | | | Salary | | Bonus | | Awards | Awards | Compensation | Compensation | | Total | | Name and Principal | | | | Salary | | Bonus | | Awards | Awards | Compensation | Compensation | | Total | | ||||||||||||||||||||

| Position | | Year | | ($) | | ($) | | ($) | ($) | ($) | ($) | | ($) | | Position | | Year | | ($) | | ($) | | ($) | ($) | ($) | ($) | | ($) | |||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

| Gerald McLaughlin1 | 2018 | 238,462 | 163,000 | - | 2,806,655 | - | 7,920 | 3,216,037 | Gerald McLaughlin1 | 2019 | 513,307 | 42,000 | - | 604,571 | 226,600 | 12,955 | 1,399,433 | ||||||||||||||||||||||||||||||||

| President and Chief Executive Officer | President and Chief Executive Officer | 2018 | 238,462 | 163,000 | - | 2,806,655 | - | 7,920 | 3,216,037 | ||||||||||||||||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Richard Eisenstadt | | 2018 | | 335,733 | | 55,122 | | 155,625 | 272,324 | - | 14,564 | | 833,368 | | Richard Eisenstadt | | 2019 | | 358,879 | | 36,748 | | - | 309,908 | 117,661 | 13,835 | | 837,031 | | ||||||||||||||||||||

| Chief Financial Officer | | 2017 | | 339,771 | | - | | 105,000 | 180,883 | 65,728 | 13,552 | | 704,934 | | Chief Financial Officer | | 2018 | | 335,733 | | 55,122 | | 155,625 | 272,324 | - | 14,564 | | 833,368 | | ||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||||

| Vipin Garg2 | 2018 | 332,340 | - | 207,500 | 363,099 | - | 646,420 | 1,549,359 | John M. Limongelli2 | 2019 | 246,250 | - | - | 272,891 | 90,582 | 2,735 | 612,458 | ||||||||||||||||||||||||||||||||

| Former President and Chief Executive Officer | 2017 | 466,166 | - | 175,000 | 301,472 | 128,827 | 39,191 | 1,110,656 | Senior Vice President, General | ||||||||||||||||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | |||||||||||||||||||||||||

| Tom McDonnell3 | | 2018 | | 302,804 | | - | | 155,625 | 272,324 | - | 262,398 | | 993,151 | | Counsel and Corporate Secretary | ||||||||||||||||||||||||||||||||||

| Former Chief Commercial Officer | | 2017 | | 304,500 | | - | | 105,000 | 180,883 | 58,905 | 13,522 | | 662,810 | | | | | | | | | | | | | | | | | | | | | | | | | | | ||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | ||||||||||||||||||||||||||

Bonus

Amounts in this column for 2019 and 2018 reflect the amount of each bonus paid to our named executive officers that was discretionarily awarded taking into account individual and company achievements. In addition, the amount reported for Mr. McLaughlin in 2018 incudes a cash sign-on bonus of $100,000.

Stock Awards

The amounts in this column represent the full grant date fair value of restricted stock unit awards made to Messrs.Mr. Eisenstadt Garg and McDonnell under the 2015 Equity Plan, computed in accordance with FASB ASC Topic 718 applying the same model and assumptions as Neos applies for financial statement reporting purposes, as described in Note 1314 to Neos' consolidated financial statements contained in its Annual Report on Form 10-K for the year ended December 31, 20182019 (disregarding any estimated forfeitures related to service-based vesting). In connection with his resignation as CEO and pursuant to the terms of his Separation Agreement and Release with the Company, the portion of all RSUs held by Dr. Garg that would have vested had he remained employed through May 31, 2019 accelerated and became vested as of his termination date.

Option Awards

The amounts in this column represent the full grant date fair value of option awards made under the 2015 Equity Plan, computed in accordance with FASB ASC Topic 718 applying the same model and assumptions as Neos applies for financial statement reporting purposes, as described

|

|

|

|

|

|

|